The Life Insurance Corporation of India (LIC), India’s largest and most trusted insurance company, is now facing a storm of discontent from its agents. This friction stems from a series of policy changes introduced by LIC, which have stirred the emotions of its agents, represented by the LIC Agents Federation of India (LIAFI). The LIC agents, who play a pivotal role in expanding LIC’s reach across the nation, now face potential setbacks in their income and professional conditions.

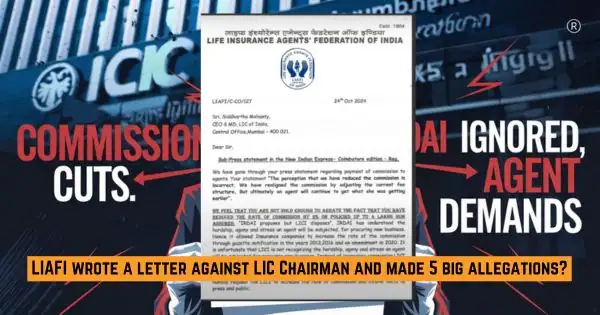

On October 24, 2024, a strongly-worded letter was issued by LIAFI to LIC CEO & MD Siddharth Mohanty, highlighting several critical issues. This article breaks down the key concerns expressed by LIAFI and explores the implications these may have for LIC and its agents going forward.

Also see: 8 Announcements from LIC Management: Good News or Just a Gimmick?

Key Issues Raised by LIAFI

The letter from LIAFI begins by addressing the concerns voiced by the LIC Chairman in the press. The Chairman claimed that the perception of reduced commissions was incorrect, stating that agent commissions had been “realigned” rather than decreased. However, LIAFI countered this assertion, listing 5 significant grievances that have arisen from LIC’s recent decisions:

1. Reduced Commission Rates for Smaller Policies

One of the most pressing concerns for LIC agents is the reduction in commission rates, particularly for policies with a sum assured of up to ₹4 lakhs. According to LIAFI, the commission has been reduced by 2%, a shift they feel was not boldly addressed in LIC’s public statements. While LIC maintains that this change is minor, agents argue it will significantly impact their earnings, especially in rural areas where smaller policy amounts are more common.

2. IRDAI Recommendations Ignored

The Insurance Regulatory and Development Authority of India (IRDAI) has repeatedly acknowledged the challenges faced by insurance agents. IRDAI had even recommended increasing commission rates to mitigate the difficulties agents face in procuring new business. However, LIC allegedly disregarded this recommendation and instead chose to decrease the commission rates further. The letter describes this move as not just disappointing but as adding to the stress and hardship agents already face.

3. Longstanding Call for Commission Increase

The issue of commission rates has been a long-standing one for LIC agents. LIAFI asserts that agents have been advocating for increased commissions since 1938. Despite LIC establishment in 1956, these grievances date back to a time when multiple private insurance companies existed. The letter references the resilience of agents, who have continued to press for better compensation but feel their pleas have gone unheard. According to LIAFI, the current reduction has only worsened this historical struggle for fair remuneration.

4. Increase in Minimum Sum Assured and Age Limits

LIC recently raised the minimum sum assured to ₹2 lakhs and capped the maximum entry age for certain policies at 50 years. LIAFI points out that this change is a direct contradiction to LIC’s stated mission of expanding insurance access to every corner of India. Many rural families, for whom a ₹2 lakh policy may be unaffordable, are now excluded from availing LIC’s offerings. This policy change effectively alienates a segment of LIC’s target market, potentially impacting LIC’s goals for growth and social reach.

5. Lack of Transparency on Premium Increases and Bonus Rates

A particularly contentious point raised by LIAFI is the lack of transparency regarding LIC’s decision to increase premium rates without public disclosure. The letter claims that LIC has been silent on this matter, neglecting to inform either the public or the media. Agents have also noted that bonus rates have been stagnant or even low, which is another point of frustration as it limits the attractiveness of policies to potential customers. LIAFI has called for LIC to provide clarity on these financial changes.

Also see: The Key Demands of LIC Agents and the Responses from LIC Management

Tensions in Communication and Representation

LIAFI letter to LIC indicates a long-standing disconnect between the management and agents regarding decision-making processes. The agents’ federation has repeatedly requested that agent leaders be involved in product development discussions, a practice that LIAFI claims LIC has ignored since 1964. By excluding agents from decision-making, LIC not only alienates its workforce but potentially misses out on valuable feedback that could enhance product appeal and effectiveness.

The letter emphasizes that the current changes were made without conducting feedback surveys or consultations with agents, resulting in policies that are out of sync with agents’ experiences and challenges on the ground.

The Larger Implications for LIC

The grievances expressed by LIAFI not only reflect dissatisfaction among agents but also suggest a broader disconnect within LIC’s operational framework. Here are some key implications that LIC might face if these issues remain unresolved:

- Agent Morale and Retention: LIC agents are the backbone of its distribution network, especially in rural and semi-urban areas. With the reduction in commission rates and the increased minimum sum assured, agent morale is likely to take a hit. Agents who feel undervalued and unheard may consider leaving LIC for other opportunities, which could weaken LIC’s distribution strength.

- Public Perception and Brand Image: The LIC brand has been built on trust and accessibility, qualities that may be eroded if agents are unable to meet the needs of clients due to restrictive policy changes. The reduced accessibility of LIC’s products for lower-income and rural customers could shift public perception, especially if agents are vocal about their dissatisfaction.

- Sales and Growth Targets: The recent policy changes could make it harder for LIC to reach its ambitious targets for growth. By setting higher minimum policy amounts and reducing commissions, LIC may inadvertently discourage new sales. In the current competitive landscape, this could create opportunities for private insurers to capture market share.

- Regulatory Scrutiny: Given that IRDAI had previously recommended an increase in commission rates, LIC’s decision to lower them may attract regulatory scrutiny. If IRDAI takes issue with LIC’s actions, LIC might face additional pressure to reassess and possibly reverse some of its decisions.

LIAFI Call for Action

LIAFI letter does not stop at airing grievances; it also includes a call to action directed at LIC leadership. In the closing section of the letter, LIAFI President asserts his willingness to face any consequences if the allegations are proven false, demonstrating his commitment to LIC agents’ cause. The letter urges LIC to reconsider the changes, seek input from agents in future decisions, and publicly disclose any adjustments to premiums or bonuses.

The letter also encourages LIC to communicate openly with the media to prevent misunderstandings regarding policy changes and their impacts on agents and customers.

Conclusion

The issues outlined by LIAFI highlight a crucial turning point for LIC. As the organization strives to grow and adapt in a rapidly evolving insurance landscape, it must not lose sight of its agents’ needs and concerns. LIC agents serve as both the face and the backbone of the corporation, especially in rural areas where they often act as trusted advisors. Addressing their grievances, involving them in decision-making, and fostering transparent communication could not only boost agent morale but also enhance LIC’s overall effectiveness in achieving its mission.

For LIC, the path forward should include restoring trust and communication between management and agents. This could mean revisiting recent decisions, actively seeking agent feedback, and working closely with IRDAI to ensure that agents receive fair compensation for their efforts. By doing so, LIC can maintain the loyalty of its agents, continue to grow its reach, and uphold its position as a cornerstone of India’s insurance industry.

FAQs

Why did LIC reduce the commission rates for agents, especially for smaller policies?

LIC adjusted commission rates in line with a “realignment” strategy to restructure fees. However, LIAFI claims this adjustment resulted in a reduction of 2% on policies with sums assured up to ₹4 lakhs, impacting agents who depend heavily on these smaller policies for their income, especially in rural areas.

What did IRDAI recommend regarding agent commissions, and did LIC follow these recommendations?

The Insurance Regulatory and Development Authority of India (IRDAI) had recommended increasing commission rates to support agents’ work in bringing in new business. However, LIC instead reduced commissions from October 1, 2024, which has led to criticism from LIAFI, who argues that the move disregards agents’ hardships.

How does raising the minimum sum assured impact LIC’s goal to expand insurance coverage across India?

Raising the minimum sum assured to ₹2 lakhs may limit accessibility for lower-income individuals, particularly in rural areas, as this higher minimum investment may be unaffordable for them. This shift, according to LIAFI, goes against LIC’s mission to reach every household in the country with affordable insurance options.

What is LIAFI’s role, and why are they opposing these changes so strongly?

The LIC Agents Federation of India (LIAFI) represents the interests of LIC agents across the country. They advocate for fair working conditions, adequate compensation, and inclusion in policy discussions. LIAFI’s opposition stems from recent changes they feel negatively affect agents’ income and their ability to offer affordable insurance to lower-income clients.

How could these recent changes affect LIC’s relationship with its agents and customers in the long term?

If these grievances are not addressed, agents’ morale and retention rates may decline, potentially weakening LIC’s distribution network. This could impact LIC customer reach and erode the trust and accessibility that have historically been core to the LIC brand, especially in rural and semi-urban areas where agents are often the primary touchpoint for clients.

Disclaimer: This article is based on a letter from the LIC Agents Federation of India (LIAFI) and reflects the perspectives and concerns outlined therein. It is intended for informational purposes only. LIC and related entities may have different views or provide clarifications on these matters. Readers are encouraged to refer to official statements and updates from LIC for comprehensive information.