The Life Insurance Agents Federation of India (LIAFI) recently expressed growing concerns to the Life Insurance Corporation (LIC) of India’s Chairman, Siddhartha Mohanty, regarding policy changes that LIAFI believes could negatively impact agents and policyholders alike. The issues raised in their recent letter highlight LIAFI dedication to protecting the interests of agents and maintaining the affordability and accessibility of LIC offerings for policyholders. Here’s an analysis of why LIAFI felt compelled to communicate these concerns again and what the key points are.

Also see: LIAFI letter against LIC chairman 5 BIG allegations

The Background of LIAFI Concerns

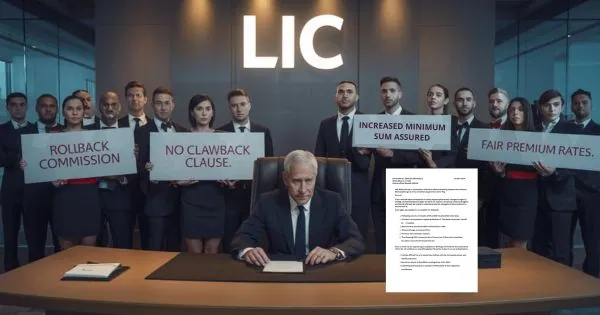

LIAFI, representing thousands of LIC agents, has previously voiced its concerns over a series of regulatory changes imposed by the LIC management. These changes, which include restructuring commission rates, implementing the clawback clause, and altering age and premium requirements, have been met with resistance from the agents who serve as LIC backbone. The recent letter underscores the agents’ frustration with LIC lack of response to their previous grievances and their urgency for these issues to be addressed promptly.

Key Points in the LIAFI Letter

In their letter to Chairman Mohanty, dated November 1, 2024, LIAFI emphasized several critical issues:

1. Restructuring of Commission Rates:

The new commission structure imposes lower rates, notably 2% and 5%, which agents argue are insufficient to sustain their livelihoods, especially when coupled with other policy changes. The previous commission rates allowed agents to earn a stable income, fostering motivation and encouraging growth. However, the new rates could potentially demotivate agents, impacting LIC’s distribution network and policy sales.

- Request for Rollback: The agents demand a rollback to the previous commission structure, arguing that these reduced commissions affect not only their earnings but also their commitment to promoting LIC products.

2. Claw-back Clause:

The introduction of a claw-back clause has created significant concern among agents, as it allows LIC to retract commissions if a policy lapses within a certain period. This clause could place undue financial stress on agents, especially considering the unpredictable nature of policy renewals.

- Demand for Removal: The agents request a written communication to clarify the removal of this clause, stating that it discourages agents from fully committing to policy promotion. The fear of commission retraction may reduce agents’ willingness to sell policies to certain demographics, especially those perceived as high-risk for lapsing.

3. Increased Minimum Sum Assured:

The recent adjustment to the minimum sum assured, now set at a higher threshold, complicates matters for agents and potential policyholders. The agents argue that raising the minimum sum assured affects affordability, deterring low-income customers from opting for LIC policies.

- Request for Reinstatement to INR 1 Lakh: Agents are pushing for a reinstatement of the previous minimum sum assured of INR 1 lakh, asserting that this amount was more manageable and attractive for the average policyholder.

4. Reduction of Age Entry Limit:

The revised age limit for entry has been reduced, a change that agents believe excludes a significant portion of potential policyholders who may still be financially active or seeking insurance coverage. The previous age limit of 60 years allowed more flexibility and inclusivity, aligning with the demographic needs of an aging population.

- Demand to Revert to 60 Years: Agents call for an increase in the entry age limit back to 60 years, which would restore access for older customers seeking life insurance or retirement planning options.

5. Enhanced Premium Rates:

The hike in premium rates has been widely criticized as it increases the financial burden on policyholders, making LIC products less competitive compared to other insurance providers. Agents believe that this increase in premium rates will reduce the appeal of LIC policies, particularly among middle-income and economically disadvantaged segments.

- Call for Premium Reduction: Agents demand a reduction in premium rates to make LIC products more accessible and competitive in the market.

6. High Interest Rates on Financial Transactions:

LIC’s decision to impose a 9.5% compound interest rate on financial transactions, including policy loans, is seen as exorbitant. Agents argue that this rate is significantly higher than market rates, placing a financial strain on policyholders, especially those in need of funds for emergencies or planned expenses.

- Request to Reduce Interest Rate: The agents propose reducing this interest rate to 4% simple interest, a move they believe would relieve policyholders’ financial stress and improve policy retention.

Impact of Changes on LIC Agents

These changes have a considerable impact on LIC agents, who are crucial for the corporation’s distribution network and customer relationships. The agents express several grievances, outlining how these new policies could hinder their ability to meet sales targets and maintain a sustainable income. They highlight three primary steps in response to these changes:

- Boycott of Official Meetings: Agents have collectively decided to boycott all official LIC meetings from November 1, 2024. This decision reflects their dissatisfaction with the management’s lack of communication and reluctance to address their concerns.

- Submission of Memorandums: Agents plan to submit memorandums to members of Parliament across various constituencies. This move aims to garner support from political leaders and advocate for policy changes that consider the well-being of agents and policyholders alike.

- Continued Peaceful Agitation: Despite the absence of an immediate response from LIC management, agents have expressed their commitment to continue their peaceful protest until their demands are met. They emphasize that their actions are in the best interest of policyholders and the longevity of LIC as a leading insurer.

Why These Issues Are Important for Agents and Policyholders

Each of the points LIAFI raised is rooted in the broader impact on both agents and the clients they serve. Here’s how each concern affects both parties:

1. Agent Financial Stability

Agents rely on commission structures for their livelihood, and with the reduced rates of 2% and 5%, they are struggling to maintain financial stability. This also affects LIC’s retention of skilled agents, as decreased commissions may drive experienced agents away from LIC, ultimately impacting the quality of service available to policyholders.

2. Policyholder Financial Flexibility

The clawback clause places a financial strain on agents, particularly when a policy lapses due to the policyholder’s financial challenges. By removing the clawback clause, LIC can relieve agents of this burden, allowing them to focus on serving clients without fear of losing earnings due to circumstances beyond their control.

3. Policy Accessibility for All Income Levels

Increasing the minimum sum assured limits accessibility for lower-income clients who may only be able to afford policies with smaller assured sums. LIAFI argues that returning to the previous minimum of ₹1 lakh would enable a broader demographic to benefit from LIC’s products, aligning with LIC’s mission to serve all sections of society.

4. Expanding Coverage to an Older Demographic

Increasing the age of entry allows older clients to secure policies, especially important as life expectancies increase. This change could help LIC expand its customer base among older individuals seeking financial products to ensure security in retirement.

5. Enhanced Affordability through Lower Premiums

Lowering premiums would make LIC policies more affordable, thus increasing the appeal to potential policyholders and aiding agents in securing more clients. This could counteract the competitive pressure LIC faces from other insurers offering more affordable options.

6. Reducing Interest Burden on Financial Transactions

The proposed reduction in transaction interest rates would relieve some of the financial burdens policyholders face, particularly when taking out loans or managing policy payments. A lower interest rate could also make LIC’s products more appealing, giving LIC a competitive edge.

Potential Long-term Effects on LIC and Policyholders

If the demands of the agents are not addressed, the long-term consequences could be significant:

- Reduced Policy Sales: The higher premium rates and minimum sum assured requirements may discourage new policy enrollments, impacting LIC overall sales and revenue.

- Increased Lapse Rates: With the introduction of the claw-back clause and high-interest rates on policy loans, policyholders might be more inclined to let policies lapse, leading to potential income loss for both agents and LIC.

- Agent Attrition: The restructuring of commission rates and stringent claw-back policies may drive LIC agents to seek opportunities elsewhere, reducing LIC’s reach and operational efficiency.

The Urgency Behind LIAFI’s Letter

LIAFI insistence on a quick response from LIC stems from the immediate financial pressures agents and policyholders are facing. Agents feel their ability to perform their roles effectively is being compromised, and policyholders may look elsewhere if LIC’s offerings become less affordable. The urgency of this letter, combined with the planned actions, is a clear indicator that LIAFI is committed to seeing these issues resolved.

Conclusion

LIAFI recent letter to LIC Chairman Mohanty serves as a reminder of the importance of dialogue and collaboration between LIC management and its agents. LIC agents are not only sales representatives but also the face of LIC for millions of Indians, and their grievances warrant attention. Addressing these issues through open communication and negotiation could strengthen LIC’s relationship with its agents and policyholders alike.

Ultimately, LIAFI actions highlight the need for LIC to reconsider policies that could undermine the corporation’s inclusive mission. By aligning with the interests of both agents and clients, LIC can foster loyalty, stability, and growth, ensuring its continued success as India’s leading life insurer.

FAQs on recent letter written by LIAFI to LIC Chairman Mohanty

What are the main issues LIAFI raised in their recent letter to the LIC Chairman?

LIAFI highlighted several concerns, including the need to roll back the recently restructured commission rates, withdraw the clawback clause, lower the minimum sum assured, increase the entry age limit, reduce premium rates, and lower the interest rate on financial transactions. These issues, they argue, would help agents maintain financial stability and improve policy affordability for customers.

What is the clawback clause, and why does LIAFI want it removed?

The clawback clause allows LIC to retrieve an agent’s commission if a policy lapses within a certain period. LIAFI opposes this clause because it penalizes agents for factors outside their control, like a policyholder’s financial difficulties. Removing this clause would ensure that agents have stable earnings even if a client’s policy lapses.

Why is LIAFI asking LIC to lower the minimum sum assured to ₹1 lakh?

LIAFI argues that a higher minimum sum assured reduces accessibility for lower-income clients who can only afford smaller policies. Lowering the minimum sum assured to ₹1 lakh would allow LIC agents to serve a broader range of clients, particularly those from economically weaker sections.

How does LIAFI’s request to increase the age of entry benefit policyholders?

By increasing the entry age to 60 years, LIAFI hopes to expand coverage options for older individuals who may want insurance policies to secure their retirement years. This change could help LIC attract more clients from older demographics, providing greater security and financial protection.

What actions has LIAFI planned if their demands are not met?

LIAFI has announced that its members will boycott official meetings starting November 1, 2024, and they plan to submit memoranda to Members of Parliament to raise awareness of these issues. Additionally, they intend to continue peaceful protests to advocate for both agents’ and policyholders’ rights until their concerns are addressed by LIC.

Disclaimer: This article is based on information provided by LIAFI in their recent communication with LIC. It reflects the viewpoints and concerns raised by the Life Insurance Agents Federation of India regarding policy changes by LIC. Readers should consider that this article represents one perspective, and for official positions and updates, they should consult LIC directly or official sources.