The IRDAI Master Circular 2024 implemented across the insurance industry on October 1, 2024, introduced significant changes in policy terms, particularly focusing on the concept of the special surrender value (SSV) for endowment policies. This article delves into the key points of this circular, examining the implications of special surrender value, guaranteed surrender value, and paid-up value on policyholders, and clarifies the complexities that these new changes bring to both old and new policyholders.

What Are Surrender Values in Life Insurance?

A surrender value is the amount an insurance company pays back to a policyholder if they choose to terminate their policy before its maturity. This value is calculated based on factors such as the type of policy, the number of premiums paid, and whether the surrender occurs within a guaranteed or special period. Traditionally, surrender values have been calculated in one of two ways:

- Guaranteed Surrender Value (GSV): The minimum guaranteed amount the insurer pays if a policy is surrendered after a specified period.

- Special Surrender Value (SSV): A potentially higher value determined by a separate formula that considers factors like government securities rates and policy tenure.

The IRDAI Master Circular 2024 clarifies that both surrender values will be available to policyholders, with the higher of the two (GSV or SSV) given upon policy surrender. This new rule is intended to make surrendering policies more flexible and beneficial for policyholders.

Also see: IRDAI 19 New Guidelines for health insurance companies

Guaranteed Surrender Value (GSV) vs. Special Surrender Value (SSV)

The guaranteed surrender value ensures that policyholders who surrender their policies after a minimum period receive a defined percentage of their total premiums paid. The structure typically allows:

- 30% to 35% of total premiums paid if surrendered within the first two or three years.

- 50% if surrendered between the fourth and seventh year.

- 90% if surrendered in the last two years of the policy’s premium term.

The special surrender value differs in that it can potentially provide a higher payout if certain conditions are met. According to the new circular, policyholders can surrender their policies after just one year instead of two, and they may receive either the GSV or SSV, depending on which is higher. This change aims to offer a fairer valuation of the policy’s worth to the policyholder at the time of surrender.

Calculating the Paid-Up Value and Surrender Values

Paid-Up Value

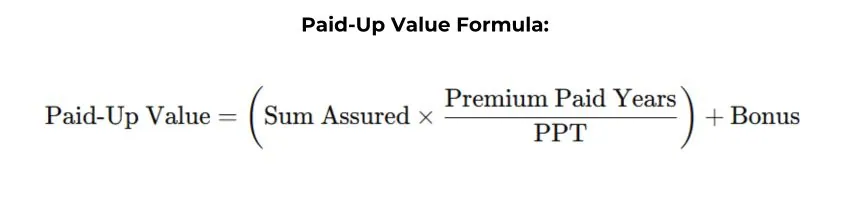

If a policyholder decides to stop paying premiums but does not surrender the policy, the policy reaches a paid-up status. The paid-up value is calculated based on the total sum assured multiplied by the ratio of paid premiums to the total policy term (referred to as the Premium Paying Term or PPT). A simplified formula is:

This bonus is a declared amount that insurance companies add based on their annual performance, influencing the policy’s maturity value.

Example Calculation

Let’s go through a step-by-step calculation using the example provided:

- Sum Assured (SA): ₹5,00,000

- Premium Paid Years: 1 year

- Premium Paying Term (PPT): 10 years

- Declared Bonus for 1 Year: ₹10,000 (Assuming the total bonus declared for a full 10-year term is ₹1,00,000)

Step-by-Step Calculation:

Calculate the Proportional Sum Assured:

- Proportional Sum Assured = Sum Assured × Premium Paid Years / PPT

- = 5,00,000 × 1 / 10

- = 50,000/-

Add the Bonus:

- Paid-Up Value = 50,000 + 10,000

- Paid-Up Value = 60,000

The paid-up value of the policy, after paying the premium for only one year, would be ₹60,000.

This example illustrates that the paid-up value consists of both the proportional sum assured based on paid premiums and the annual bonus declared by the insurance company.

Special Surrender Value

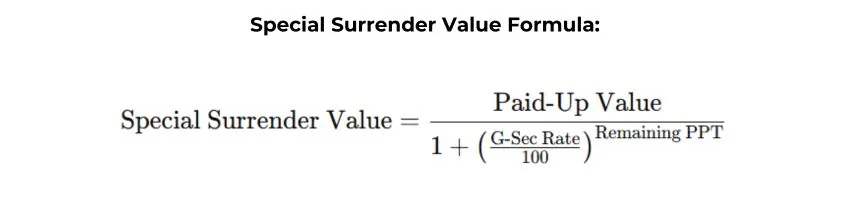

The formula for the special surrender value considers the paid-up value, adjusted by a government securities rate (G-Sec). The calculation requires using a 10-year average rate of G-Sec, currently at 7.5%. Here’s how the SSV is calculated:

For instance, if a policyholder with a paid-up value of ₹60,000 has 9 years remaining on a 10-year policy, the special surrender value could be calculated as follows:

Step-by-Step Calculation

Step 1: Substitute the values into the formula:

- Paid-Up Value (PUV) = ₹60,000

- G-Sec Rate = 7.5% or 0.075 when converted for calculation

- Remaining PPT = 9 years

Step 2: Calculate the base of the denominator using 1 + 𝐺-Sec Rate / 100 = 1 + 7.5 / 100 = 1.075

Step 3: Raise the base to the power of the Remaining PPT (9 years): (1.075)9 ≈ 1.746

Step 4: Divide the Paid-Up Value by this result to find the SSV: 60,000 / 1.746 ≈ 31,295

After completing the calculation, we find that the Special Surrender Value (SSV) is approximately ₹31,295.

This example illustrates how the SSV formula leverages the G-Sec rate and the remaining premium payment years to determine a fair surrender value.

Implications for Policyholders with Old vs. New Policies

One of the most contentious points in the circular is whether the SSV benefits apply to existing (old) policies or only to new policies issued after October 1, 2024. The circular does not explicitly clarify this, leading to considerable confusion among policyholders. Customers have reported visiting insurance offices to surrender old policies, only to be turned away due to a lack of definitive guidance.

The IRDAI has made it clear that policies can undergo changes like personal details updates or contact information corrections, but the core terms and conditions of existing policies cannot be modified. Therefore, it is believed that the new special surrender value provisions apply solely to policies initiated on or after October 1, 2024. Older policies will continue to follow the traditional guaranteed surrender value, based on the original terms.

Key Changes Introduced in the Master Circular 2024

The Master Circular 2024 has introduced several key updates that affect the way surrender values are calculated and applied:

- Policy Surrender Eligibility After One Year: Previously, surrender was typically allowed only after a two-year holding period, but policyholders can now surrender policies as early as one year into the term.

- Distinction Between Old and New Policies: One of the more confusing aspects of the new guidelines is whether these surrender values apply to policies issued before October 1, 2024. As clarified, the new Special Surrender Value calculations apply only to policies issued after October 1, 2024. Existing policies retain the previous GSV terms, creating a distinction that is critical for long-time policyholders to understand.

- Calculation Transparency: By defining the formulas for both Guaranteed and Special Surrender Values, the IRDAI has aimed to increase transparency, enabling policyholders to make informed decisions about whether to maintain or exit their policies.

How the New Surrender Value Affects Different Policy Types

The surrender value calculations can vary depending on the type of policy:

- Endowment Policies: These policies often have a bonus component that affects the final maturity amount. For endowment policyholders, the surrender value will factor in accrued bonuses, adding a layer of potential value depending on the insurer’s declared rates over time.

- Money-Back Policies: For money-back policies, the surrender value calculations can differ slightly as these policies return periodic payouts during the policy term. The impact of periodic payouts on GSV and SSV means policyholders may see slightly reduced surrender values compared to endowment policies due to the money already returned during the policy term.

Key Takeaways for Policyholders

The IRDAI’s new guidelines on surrender values represent a dual approach, with both Guaranteed and Special Surrender Values available based on the policy’s age and the holder’s preferences. This dual structure provides flexibility while ensuring transparency in calculations. Here’s what policyholders need to remember:

- Eligibility for Surrender: Policies are now eligible for surrender after just one year, offering more flexibility for policyholders facing financial difficulties.

- Choosing Between Surrender Values: Policyholders should evaluate both the Guaranteed and Special Surrender Values to make an informed decision. In cases where the Special Surrender Value is higher due to favorable economic conditions or accrued bonuses, it may be a better choice.

- Limitations for Existing Policies: Existing policyholders will retain the original Guaranteed Surrender Value terms, as the Special Surrender Value applies only to policies issued after the October 1, 2024, cutoff. This is particularly significant for long-standing policyholders, as the terms of their surrender options will remain fixed.

- Endowment and Bonus Policies: For policyholders with endowment or money-back policies that accumulate bonuses, the guaranteed and special surrender values could vary depending on how much bonus has been accrued, making it crucial to understand these potential earnings.

- Market-Linked Nature of SSV: Since the Special Surrender Value depends on the G-Sec rate, it is more market-linked, which could benefit or limit policyholders depending on broader economic trends.

Conclusion

The revised guidelines on surrender value calculation from the IRDAI introduce a fresh approach to managing life insurance policies, aligning surrender values more closely with market dynamics and policyholder flexibility. By understanding the differences between Guaranteed Surrender Value and Special Surrender Value, policyholders can make well-informed decisions that best serve their financial needs.

Whether you hold an endowment policy, a money-back policy, or another form of life insurance, the option to surrender early or maintain the policy to maturity is now backed by a clear and detailed framework. As these changes settle in, policyholders are encouraged to consult with their insurers to understand the exact surrender values applicable, especially if they are considering early termination. The Master Circular 2024 brings a new era of clarity and choice to life insurance, allowing each policyholder to make decisions that reflect their financial priorities and circumstances.

FAQs on Surrender Values Under the IRDAI Master Circular 2024

What is the difference between Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV)?

The Guaranteed Surrender Value (GSV) is the minimum amount a policyholder is entitled to receive if they decide to surrender their policy, based on a percentage of the total premiums paid. The Special Surrender Value (SSV) can offer a higher return as it considers factors like paid-up value, the government securities rate, and the remaining premium-paying term. Under the IRDAI Master Circular 2024, policyholders can receive the higher of the two values when they surrender a policy.

Can I surrender my policy under the new rules if I have only paid premiums for one year?

Yes, according to the new IRDAI rules, policyholders can now surrender their life insurance policy after paying premiums for just one year. This change provides more flexibility for policyholders who may decide early on that they no longer wish to continue with the policy.

Does the IRDAI Master Circular 2024 apply to old policies issued before October 1, 2024?

The IRDAI circular does not specify whether the Special Surrender Value (SSV) formula applies retroactively to policies issued before October 1, 2024. Most indications suggest that the updated SSV rules are only applicable to policies issued after this date, meaning that older policies would likely still follow their original surrender terms with only the Guaranteed Surrender Value (GSV) available.

How is the Special Surrender Value (SSV) calculated?

Answer: The SSV is calculated using a formula that involves the paid-up value of the policy, the government securities rate, and the remaining premium-paying years. The formula is as follows:

This formula ensures that the SSV reflects current market conditions and offers a potentially higher return based on the policy’s remaining term and interest rates.

How can I check my policy’s surrender value under the new IRDAI rules?

Answer: To determine the surrender value of your policy under the new IRDAI rules, it is best to contact your insurance provider directly. They can provide the exact Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV) calculations based on your policy type, premiums paid, and remaining term, allowing you to make an informed decision about surrendering your policy.

Disclaimer: This article is for informational purposes only and should not be considered as financial or legal advice. Policyholders are encouraged to consult with their insurance providers or financial advisors to understand specific policy terms and implications of the IRDAI Master Circular 2024. Individual policies may vary, and surrendering policies can have financial consequences that should be carefully evaluated.