Benefits of ManipalCigna Lifetime Health Insurance Plan- In today’s fast-paced world, health insurance has become more of a necessity than a choice. The escalating costs of medical treatment, coupled with the rising prevalence of chronic diseases, make it imperative to have a robust health insurance plan in place. One such plan that has been designed to cater to a wide range of healthcare needs is the ManipalCigna Lifetime Health Insurance Plan. This plan offers extensive coverage, not only within India but also abroad, ensuring that policyholders are safeguarded against financial hardships arising from medical expenses.

This article will delve into the numerous benefits offered by this plan, illustrating why it could be an ideal choice for individuals seeking robust health insurance coverage.

Also see: Best Health Insurance Plans with BP and Diabetes Cover from day one

Overview of the ManipalCigna Lifetime Health Insurance Plan

The ManipalCigna Lifetime Health Insurance Plan is a comprehensive health insurance solution that offers a sum assured ranging from ₹50 lakh to ₹3 crores. This wide range of coverage ensures that individuals can choose a plan that best suits their financial and healthcare needs. One of the standout features of this plan is its global coverage, which provides policyholders the flexibility to seek medical treatment not just in India but also abroad.

In addition to the basic coverage, the plan also offers several optional covers, including the Health Plus, Women Plus, and Global Plus packages. These packages are designed to provide additional protection for specific healthcare needs, making the plan even more customizable and beneficial for policyholders.

Also see: which LIC plans are closing from 30 September

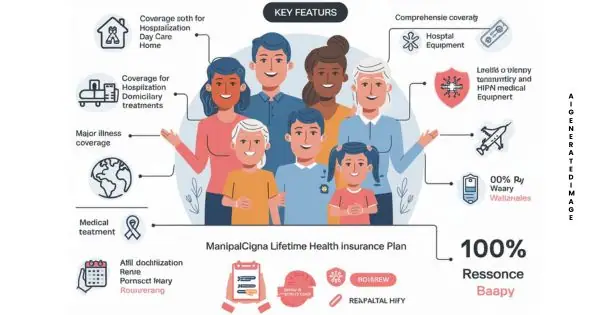

Key Benefits of ManipalCigna Lifetime Health Insurance Plan

The ManipalCigna Lifetime Health Insurance Plan offers a range of benefits that ensure comprehensive healthcare coverage for policyholders. Below are some of the key benefits:

- Hospitalization, Day Care, and Domiciliary Expenses

This plan covers a broad spectrum of medical expenses, including hospitalization, day care procedures, and domiciliary treatments (treatment at home when hospitalization is not possible). These coverages ensure that policyholders can receive the necessary medical attention without worrying about the financial implications. Whether it’s a minor day care procedure or an extended hospital stay, this plan has got you covered.

- Coverage for Major Illnesses

If diagnosed with a major illness such as cancer or a tumor, the ManipalCigna Lifetime Health Insurance Plan covers treatment costs, both within India and abroad. This benefit is crucial as it allows policyholders to seek the best possible treatment, irrespective of location, ensuring that they receive top-tier care.

- Advanced Treatment Coverage

The plan covers advanced medical treatments, including robotic surgery, cyberknife surgery, and treatments for diseases like HIV/AIDS and sexually transmitted diseases (STDs). This feature ensures that policyholders can access the most advanced and effective treatments available, without being hindered by high costs.

- Adult Health Checkups and Preventive Care

Preventive care is vital for early detection and management of health issues. The plan includes coverage for adult health checkups, mental health care, and AYUSH treatments (Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy). This comprehensive approach to preventive care helps maintain overall health and well-being.

- Medical Evacuation, Recovery, and Global Travel Vaccination

The ManipalCigna Lifetime Health Insurance Plan covers medical evacuation expenses during emergencies abroad, including the cost of returning to India after treatment. Additionally, it covers global travel vaccinations, which are often necessary when visiting certain regions. This ensures that policyholders are protected from unforeseen medical expenses while traveling.

- 100% Restoration Benefit

A significant advantage of the ManipalCigna Lifetime Health Insurance Plan is the 100% restoration benefit. If the sum insured is exhausted due to a claim, the plan restores the full sum insured for any subsequent claims within the same policy year, regardless of whether they are related to the initial claim. This feature provides continuous coverage and peace of mind, even after a significant claim.

- Premium Waiver Benefit

The plan also offers a premium waiver benefit, where policyholders making a claim of ₹2 lakhs or more are exempt from paying the premium for the next policy year. This benefit alleviates financial stress during recovery from a serious illness, ensuring that coverage continues without additional costs.

Also see: Niva Bupa Health Insurance Claim Process Hindi

Optional Covers: Customizing Your Plan

To enhance the coverage, the ManipalCigna Lifetime Health Insurance Plan offers three optional packages: Health Plus, Women Plus, and Global Plus. These packages allow policyholders to tailor their insurance plan to better suit their specific needs.

- Health Plus Package

The Health Plus package is designed to provide additional coverage for critical illnesses and other high-risk health conditions. This package may include higher coverage limits for specific diseases, additional benefits for hospitalization, and enhanced protection against unforeseen medical expenses. It is ideal for individuals who have a family history of critical illnesses or who want to ensure comprehensive protection against potential health risks.

- Women Plus Package

The Women Plus package is tailored specifically for women, addressing their unique health concerns. It includes coverage for screening and treatment of four types of cancer, including breast cancer and cervical cancer. The package also covers care for osteoporosis, a condition that disproportionately affects women as they age. This package is an excellent choice for women who want to take proactive steps in managing their health and ensuring access to necessary medical care.

- Global Plus Package

The Global Plus package is designed for those who travel frequently or who may seek medical treatment abroad. It includes coverage for global outpatient department (OPD) expenses, which are medical expenses incurred outside of a hospital setting, such as consultations, diagnostic tests, and minor procedures. Additionally, this package offers coverage for chemotherapy and radiotherapy, which are common treatments for cancer, ensuring that policyholders have access to essential treatments, no matter where they are in the world.

Why Choose the ManipalCigna Lifetime Health Insurance Plan?

There are several reasons why the Mani Pal Cigna Life Time Health Insurance Plan stands out as a top choice for health insurance coverage:

- Comprehensive Coverage: The plan offers extensive coverage for a wide range of medical expenses, including hospitalization, major illnesses, advanced treatments, and more.

- Global Reach: With coverage available in India and abroad, policyholders have the flexibility to seek treatment wherever they feel they will receive the best care.

- Customizable Options: The optional covers allow policyholders to tailor their insurance plan to meet their specific needs, ensuring that they are adequately protected against potential health risks.

- Financial Security: The plan’s benefits, such as the 100% restoration benefit and premium waiver, provide financial security and peace of mind, knowing that you are continuously covered, even in the face of significant medical expenses.

Conclusion

The ManipalCigna Lifetime Health Insurance Plan offers a robust and flexible health insurance solution, designed to cater to a wide range of healthcare needs. With its extensive coverage, global reach, and customizable options, it provides policyholders with the confidence and security they need to manage medical expenses effectively.

Choosing the ManipalCigna Lifetime Health Insurance Plan is a proactive step towards safeguarding your health and financial well-being. Whether you need basic coverage or a plan that accommodates advanced treatments and global travel, this plan offers the protection you need to navigate life’s uncertainties with confidence.

FAQs about ManipalCigna Lifetime Health Insurance Plan Benefits

Here are some frequently asked questions (FAQs) about the ManipalCigna Lifetime Health Insurance Plan to help clarify key aspects of the policy:

What is the minimum and maximum sum insured under the ManipalCigna Lifetime Health Insurance Plan?

The plan offers a wide range of sum insured options, starting from ₹50 lakh and going up to ₹3 crores. This flexibility allows policyholders to choose a coverage amount that aligns with their healthcare needs and financial capacity.

Does the plan cover treatment for pre-existing conditions?

Yes, the plan covers pre-existing conditions, but there is typically a waiting period before claims related to these conditions can be made. The exact waiting period may vary, so it’s important to review the policy documents or consult with the insurance provider for specific details.

What types of advanced treatments are covered under the plan?

The ManipalCigna Lifetime Health Insurance Plan covers a range of advanced treatments, including robotic surgery, cyberknife surgery, and treatments for diseases like HIV/AIDS and STDs. These coverages ensure access to cutting-edge medical procedures without worrying about high costs.

Is there a limit on the number of times the restoration benefit can be availed?

The 100% restoration benefit can be availed multiple times in a policy year, but it cannot be used for the same illness for which a claim has already been made. This means that the benefit is available for subsequent claims related to different illnesses.

What is the premium waiver benefit, and how does it work?

The premium waiver benefit exempts the policyholder from paying the premium for the next policy year if a claim of ₹2 lakhs or more is made. This benefit helps reduce financial stress by ensuring that coverage continues without additional costs during a challenging time.

How does the Global Plus package work for treatments abroad?

The Global Plus package provides coverage for outpatient department (OPD) expenses incurred abroad, including consultations, diagnostic tests, and minor procedures. It also covers treatments like chemotherapy and radiotherapy, ensuring that policyholders have access to essential healthcare services globally.

What is covered under the Women Plus package?

The Women Plus package is specifically designed for women and includes coverage for screenings of four types of cancer, including breast and cervical cancer, as well as care for osteoporosis. This package addresses unique health concerns that women may face, offering proactive health management options.

Are mental health treatments covered under the plan?

Yes, the ManipalCigna Lifetime Health Insurance Plan includes coverage for mental health care. This is part of the plan’s broader approach to comprehensive health coverage, recognizing the importance of mental health in overall well-being.

Can I customize my policy with multiple optional covers?

Absolutely. Policyholders can opt for one or more of the optional packages—Health Plus, Women Plus, and Global Plus—based on their specific needs. These add-ons allow you to tailor the policy to provide additional protection where you need it most.

What is the waiting period for claims related to maternity under the plan?

The waiting period for maternity-related claims typically ranges from 24 to 48 months, depending on the specific terms of the policy. It’s important to check the policy documents or consult with the insurance provider for precise details regarding the waiting period.

Does the plan cover expenses for vaccinations?

Yes, the plan covers expenses for global travel vaccinations, which are often required when visiting certain regions of the world. This benefit ensures that policyholders are protected against potential health risks while traveling.

Is there a cashless facility available under the ManipalCigna Lifetime Health Insurance Plan?

Yes, the plan offers a cashless facility at network hospitals. This means that policyholders can receive treatment without paying upfront, as the insurance provider directly settles the bill with the hospital. This is a significant convenience, especially during emergencies.

How does the domiciliary treatment coverage work?

Domiciliary treatment coverage applies when a policyholder is unable to get admitted to a hospital due to a lack of available beds or when they are advised to receive treatment at home by a medical professional. The plan covers the medical expenses incurred during such home-based treatment.

What documents are required to make a claim under this plan?

The required documents typically include the claim form, original hospital bills, discharge summary, doctor’s prescriptions, diagnostic test reports, and any other relevant medical documents. It’s advisable to keep copies of all documents and consult with the insurance provider for a detailed list of required documents.